What is the business performance and financial condition of the company?

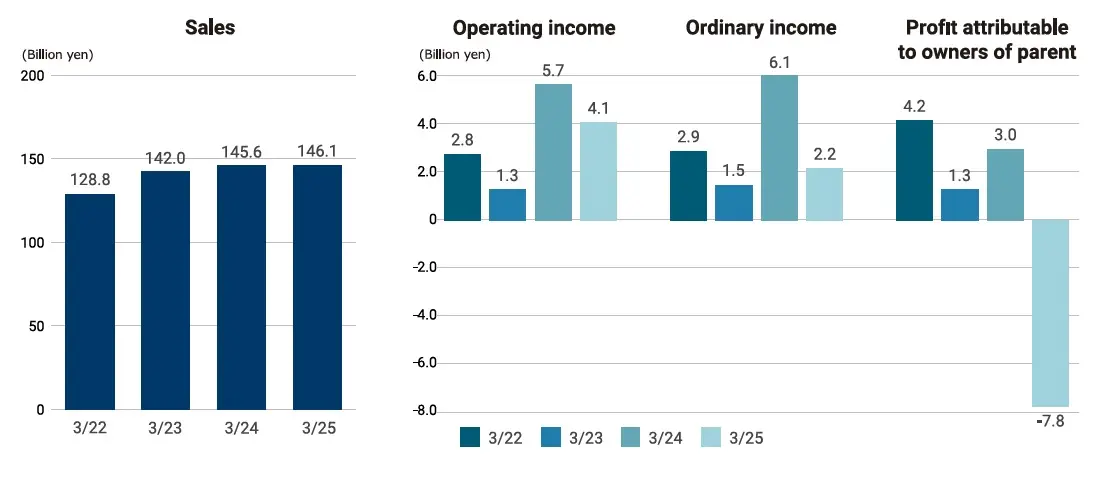

Movements in business performance

Business performance for fiscal year ended March 31, 2025

Net sales reached ¥146.1 billion, driven by higher production in North America and favorable exchange rates, despite production decreases in China and Asia.

Operating profit was ¥4.1 billion, despite efforts to improve costs and adjust sales prices, due to the impact of reduced production in China and Asia.

Despite gains from the sale of investment securities, impairment losses in China and a loss from the sale of the Mexican subsidiary led to a net loss of ¥7.8 billion.

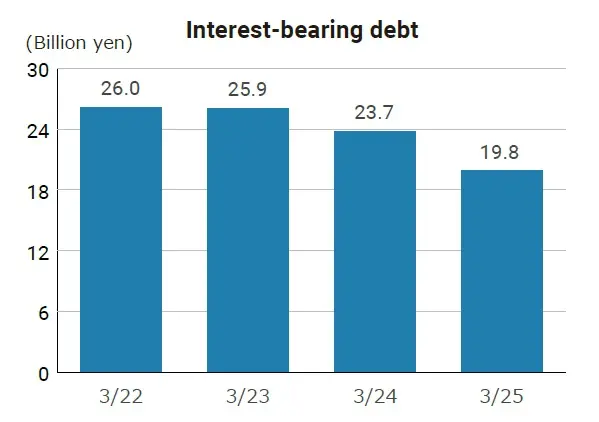

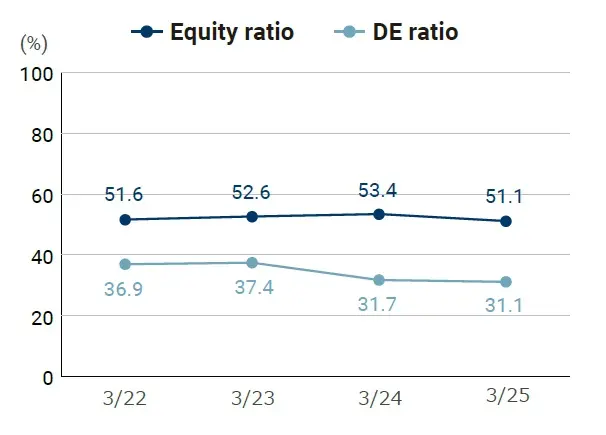

Financial base

We have built a solid financial base while taking into consideration the balance between equity and interest-bearing debt.

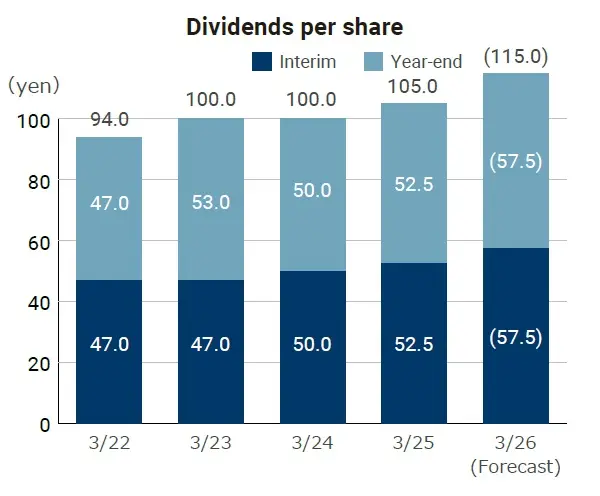

Shareholder returns

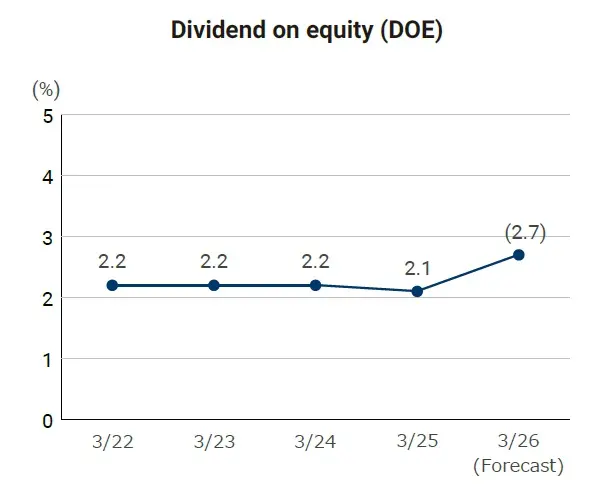

We have positioned the return of profits to its shareholders as one of its priority management policies. Our basic policy in this regard is to continue distributing stable dividends while securing the internal reserves needed to accommodate our future business development and shifts in our operating environment.

With respect to dividends, we use the dividend on equity (DOE) as a key indicator and aim to raise it to a level of 3.0% by the fiscal year ended March 31, 2028.

In addition, we strive to enhance shareholder returns through the flexible acquisition and cancellation of treasury shares.

Back to the index of "To all individual investors"