Climate Change Initiatives

Basic Concept

In alignment with the Moriroku Group Sustainability Policy, our objective is to become a“400-year company,”a trusted and valued entity that is widely recognized as a leader in sustainable business practices. We are committed to engaging in business activities that prioritize the interests of all stakeholders and contribute to addressing social challenges, with the aim of fostering a sustainable society.

We have identified climate change as a critical sustainability issue and in October 2022, we expressed support for the recommendations made by the Task Force on Climate-related Financial Disclosure (TCFD). In line with this recommendation, we will work to enhance information disclosure in the following areas: governance, strategy, risk management, and indicators and targets. This will enable us to reduce our environmental impact and increase our corporate value.

Disclosure based on TCFD recommendations

Governance Structure for Environmental Issues

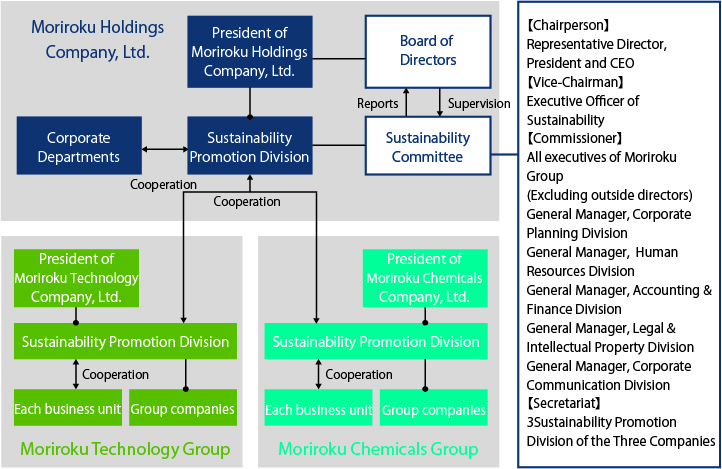

At Moriroku Group, the Board of Directors deliberates and resolves on basic policies, important issues, and the setting of important targets regarding sustainability management, including climate change issues. KPIs related to environmental issues are incorporated into the mid-term management plan and reflected in the target setting of each operating company.

Sustainability Committee

To actively promote sustainability management throughout the Moriroku Group, the Sustainability Committee, chaired by the president of Moriroku Holdings and vice-chaired by the director in charge of sustainability, is held four times a year. The committee is responsible for formulating Group policies, identifying key sustainability issues, discussing sustainability strategies, and monitoring the status of efforts to address key issues. The Committee's decisions are reported to the Board of Directors twice a year and incorporated into the Group's overall plan based on the supervision and advice of outside directors. The Sustainability Promotion Office of Moriroku Holdings provides secretariat services to the Committee, which works closely with Moriroku Technology and Moriroku Chemicals.

Linkage between Climate Change Response and Executive Compensation

Effective with the fiscal year ending March 31, 2023, we have decided to include the achievement of key KPIs (GHG emissions reduction rate of 50% (target: end of FY2030), renewable energy adoption rate of 55% (target: end of FY2030)) as a portion of executive compensation.

Strategy

Scenario Selection

In analyzing potential scenarios, the Moriroku Group assumed a "1.5-2°C scenario," which represents a scenario in which decarbonization policies are pursued, and a "4°C scenario," which represents a scenario in which decarbonization policies are implemented to a limited extent. The Group then analyzed the impact of these scenarios on the business.

|

Scenario

|

Reference Scenario Example

|

Image of the world

(Forecast based on scenario) |

|---|---|---|

|

1.5 to 2°C

|

IEA:NZE/SDS

IPCC:RCP2.6 |

・Government takes an active role in combating climate change for a sustainable society.

・Carbon price and other CO2 emission costs will increase

・Electricity will be increasingly generated by solar power and other renewable energy sources |

|

4°C

|

IEA:STEPS

IPCC:RCP6.0 |

・Governments not stepping up climate action

・Expenditures such as carbon prices are expected to have little impact, while costs will increase due to more severe extreme weather events

・Electricity generation methods will continue to rely on fossil fuels

|

Scenario-based analysis of main risks/opportunities and discussion of countermeasures

The Sustainability Committee identified key risks and opportunities related to climate change, and discussed measures to address them. The table below lists the main climate change-related risks and opportunities that were gleaned from these discussions with regards to the Group’s businesses.

The time frames listed in the table were assumed to be as follows: by 2025 for short-term, by 2030 for mid-term, and by 2050 for long-term.

Moriroku Group - Analysis of risks/opportunities related to climate change (as of November 2022)

Time frames: 4-10 years (by 2030) for medium-term, 11-25 years (by 2050)

Mid-term: 4 to 10 years (2030) Long-term: 11 to 25 years (2050)

-

Analysis of Climate Change Risks and Opportunities (as of November 202●)

|

Risk category

|

Business Impact

|

Financial Impact

|

||

|

Time frame

|

Risks/Opportunities

|

|||

|

Policy and Regulation

|

Carbon price (carbon tax) emissions trading

|

Medium- to long- term

|

Risks

【Common across Group】

· Cost of tax burden if carbon taxes are implemented

· Costs incurred if the scope of carbon emissions trading is expanded

|

large (e.g. serving size)

|

|

Plastics Regulation

|

Medium- to long- term

|

Risks

【Common across Group】

· Recycling regulations prohibiting the use of certain materials, or making them subject to management

Moriroku Technology, Inc.

【Moriroku Technology】

· Decrease in revenue due to lower demand for plastic products when the use of plastics in automobiles, etc., is regulated

· Increase in costs due to switch from petroleum-derived plastics to alternative materials such as biomass plastics

【Moriroku Chemicals】

· Decrease in revenue due to lower sales of resin-related products if plastic use is regulated

|

large (e.g. serving size)

|

|

|

Opportunities

【Moriroku Technology】

·Increase in competitiveness due to the development of new parts, etc., through the technological development of materials that could serve as alternatives to plastics

· More efficient manufacturing processes due to the use of recycling within plants

【Moriroku Chemicals】

· Increase in sales due to the expansions in the sales of new materials such as biomass plastics

· Expansion in opportunities for recycling businesses

· Increase in value chain revenue through the provision of chemical solutions

|

large (e.g. serving size)

|

|||

|

technology

|

Advances in low-carbon technologies

|

Medium- to long- term

|

Risks

【Common across Group】

· Decrease in demand for existing products and services due to the replacement of such products and services with low-carbon products and services

·Increase in costs due to the development of technologies, the use of new technologies, upfront investment in facilities, etc., in shifting to low-carbon products and services

|

large (e.g. serving size)

|

|

Opportunities

【Common across Group】

· Increase in demand and revenue for environmentally friendly products and materials based on Moriroku Technology and Moriroku Chemicals working together to develop biomass plastic materials

【Moriroku Technology】

· Increase in revenue due to rising demand for low-carbon products caused by the development and deployment of low-carbon products

· Expansion in business opportunities and increase in revenue due to advancements in and widespread use of EV technologies

· Increase in energy efficiency and decrease in operating costs for production processes and production itself, due to the development of low-carbon emission equipment.

【Moriroku Chemicals】

·Increase in demand and revenue due to the development of environmentally friendly materials

·Increase in sales opportunities due to company efforts to develop environmentally compatible materials

|

large (e.g. serving size)

|

|||

|

(the) market (as a concept)

|

Change in energy costs

|

Medium- to long- term

|

Risks

【Common across Group】

·Increase in operating costs in complying with policy enhancements to drive the shift towards low-carbon emission energy, measures to improve energy efficiency, etc.

·Decrease in demand for existing products and services due to the replacement of such products and services with products and services that are energy-efficient and/or that utilize low-carbon emission energy

·Increase in manufacturing costs due to the development and implementation of low-carbon technologies/equipment

·Increase in costs due to higher electricity prices as a result of the widespread use of renewable energy

|

large (e.g. serving size)

|

|

Opportunities

【Common across Group】

·Decrease in operating costs due to the use of efficient production/logistics processes, efficient means of transportation, etc.

·Increase in demand and revenue due to the development and deployment of low-carbon emission energy, energy-efficient products/services, etc.

|

large (e.g. serving size)

|

|||

|

Changes in raw material costs

|

Medium- to long- term

|

Risks

【Common across Group】

·Increase in material procurement costs due to the rising prices for resins, minerals, etc.

· Increase in costs due to rising raw material prices when switching to alternative materials

· Increase in costs due to rising raw material prices when supply chains for such materials are cut off due to natural disasters

|

large (e.g. serving size)

|

|

|

Opportunities

【Group common】

· Reduce raw material costs by reducing raw material usage, in-process recycling, and considering cheaper and more abundant alternatives

|

large (e.g. serving size)

|

|||

|

Products & Services

|

Medium- to long- term

|

Risks

【Group common】

·Loss of opportunities due to delays in efforts to develop recycling-based raw materials

|

during (a certain time when one did or is doing something)

|

|

|

Opportunities

【Common across Group】

·Efforts to reduce Group's environmental burden through life cycle assessments (LCAs)

【Moriroku Chemicals】

·Increase in revenue due to the development of recycling-based raw materials (low-carbon, biodegradable/biomass plastic materials, etc.)

·Increase in revenue due to the provision of raw materials and products adapted to the changes in consumer needs that arise from the rising temperatures

·Increase in revenue due to the supplying of new products and services that fit customer adaptation needs in response to climate change, such as health maintenance/disease prevention, resilience enhancement, etc., in areas such as healthcare, agriculture/food, and infrastructure

【Moriroku Technology】

·Increase in revenue due to the development of a wide variety of plastic products, including automobile parts

|

large (e.g. serving size)

|

|||

|

Reputation

|

Changes in Group reputation amongest external stakeholders

|

Medium- to long- term

|

Risks

【Common across Group】

·Decrease in revenue due to customer transaction restrictions if evaluations find the Group's environmental considerations to be inadequate

·Loss of reputation due to the insufficient disclosure of environment-related information

·Decrease in procurement funds and increase in financing costs if the Group's environmental considerations are deemed inadequate

|

large (e.g. serving size)

|

|

Opportunities

【Common across Group】

·Increase in credibility and revenue due to environmentally friendly measures and sufficient information disclosure

·Strengthening of business continuity ability and increase in supply chain credibility and market value due to measures by the company and within the supply chain to address climate change

【Moriroku Technology】

·Increase in corporate value due to the reputation boost derived from increased demand following the development of environmentally compatible productsnge

【Moriroku Chemicals】

·Increase in corporate value due to higher evaluations from environment-related businesses

|

|

|||

Physical risk (analysis based on 4°C scenario)

|

risk category

|

Business Impact

|

Financial Impact

|

||

|

Time frame

|

Risks/Opportunities

|

|||

|

Acute (e.g. illness)

|

Increase in severity of extreme weather events (typhoons, torrential rain, landslides, etc.)

|

Medium to long term

|

Risks

【Common across Group】

·Increase in disaster-related repair costs due to the increased frequency of extreme weather events

·Decrease in manufacturing ability, production volume, etc., and decrease in sales due to sudden manufacturing stoppages or suppply chain disruptions caused by extreme weather events

·Difficulties in supplying substitute products, increase in raw material costs, etc., due to disruptions of raw material supply networks caused by extreme weather events

·Increase in response costs due to the risk of damage to facilities and equipment, procurement risks for raw materials, fuel, etc., and risks in the supplying of products, due to extreme weather events

【Moriroku Technology】

·Material procurement issues due to damage to suppliers from which the company sources its materials, caused by extreme weather events

【Moriroku Chemicals】

·Disruptions in purchasing and sales networks due to the increased frequency of extreme weather events

|

large (e.g. serving size)

|

|

Opportunities

【Common across Group】

·Avoidance of procurement risks and establishment of superiority using the Group's supply response capabilities, based on production in multiple sites across the world

·Increase in revenue through entry into the mobility area, which is utilized in the event of disasters (floods, heat waves, etc.)

|

large (e.g. serving size)

|

|||

|

chronic

|

Average temperature increase

|

Medium to long term

|

Risks

【Common across Group】

·Increase in costs due to the increased use of air conditioners in offices

·Increase in time spent on employee health care/management and decrease in productivity due to rising temperatures

|

small

|

Risk Management

Process for determining and monitoring key risks

The Moriroku Group has established the materiality of sustainability issues that should be taken on by the Group as a whole, according to its understanding and analysis of the current status of each operating company, and a close examination of risks common to the Group overall. We then identify high-priority risks by analyzing these key issues comprehensively, in terms of their impact and importance to the Group, from the perspective of Group-wide management.

Risks and decision-making processes with regards to the issue of climate change are established through discussions within the Board of Directors meetings. The Group also works to review these risks and opportunities as needed, in response to changes in the business environment and the progress of business strategies. These are discussed first within the Sustainability Committee, then presented as proposals to the Board of Directors.

Metrics and goals

Medium-Term Targets

The Moriroku Group has set a goal to reduce GHG emissions in Scope 1 and 2 by 50% by the end of FY2030 (base fiscal year: 2019). We will work to steadily reduce emissions in Scope 1 and 2, through the implementation of measures such as renewable energy, while also working with suppliers to gain an understanding of and reduce emissions in Scope 3, in order to achieve our KPIs.

-

Reference: Key KPIs for the promotion of sustainability

Scope 1, 2, and 3 emissions (Total across three companies)

|

Scope

|

Fiscal year ended March 2023

|

|

|---|---|---|

| CO2 emissions [CO2 e-t] | Percentage [%] | |

|

Scope1

|

4,460.29

|

1.07

|

|

Scope 2 (market standard)

|

2,951.66

|

0.71

|

|

Scope3

|

409,048.51

|

98.22

|

|

Total

|

416,460.46

|

-

|

*Scope 1,2,3 emissions (total of Moriroku Holdings, Moriroku Technology, and Moriroku Chemicals)

*Moriroku Holdings, Moriroku Technology, Moriroku Chemicals

Breakdown of Scope 3 emissions (Total across three companies)

|

category

|

Fiscal year ended March 2023

|

||

|---|---|---|---|

| CO2 emissions [CO2 e-t] | Percentage [%] | ||

|

Category 1

|

Products and services purchased

|

389,758.31

|

95.28

|

|

Category 2

|

Capital goods

|

1,856.06

|

0.45

|

|

Category 3

|

Fuel and energy-related activities not included in Scope 1 and 2

|

2,003.75

|

0.49

|

|

Category 4

|

Transportation, delivery (upstream)

|

12,726.91

|

3.11

|

|

Category 5

|

Waste from business operations

|

935.12

|

0.23

|

|

Category 6

|

Business trip

|

1,434.16

|

0.35

|

|

Category 7

|

Employer commutes

|

334.20

|

0.08

|