Remuneration for Directors

Basic Philosophy

Moriroku regards its remuneration system for directors as a mechanism to secure, retain, and motivate human resources who are essential for the sustainable enhancement of corporate value.

Remuneration levels for officers are determined based on the Company’s business environment and on remuneration levels at major companies of a similar size.

Director Remuneration

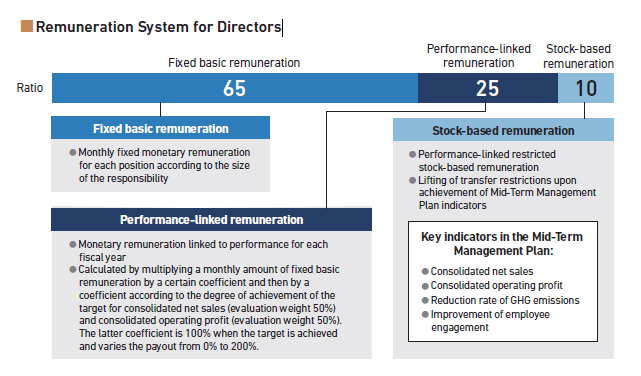

Remuneration for directors (excluding outside directors and Audit & Supervisory Committee members) comprises fixed basic, performance-linked, and stock-based components, with a ratio of approximately 65:25:10. Fixed basic remuneration is a fixed monthly monetary remuneration for each position according to the scope of responsibility. Performance-linked remuneration is a short-term monetary incentive that varies based on the Company’s annual performance—specifically consolidated net sales and consolidated operating profit.

Stock-based remuneration is a performance-linked restricted stock plan designed to incentivize medium- to long-term performance and enhance corporate value, based on performance, management indicators, and other factors. In principle, it is granted in the first year of the Mid-Term Management Plan. The granting of shares during the term of office reinforces alignment with shareholders through value sharing. Lifting of the transfer restrictions is contingent upon the achievement of the key management indicators listed in the Mid-Term Management Plan. Management indicators for the Mid-Term Management Plan include financial indicators (consolidated net sales and consolidated operating profit in the final year of the Mid-Term Management Plan) and sustainability indicators (GHG emission reduction rate and employee engagement improvement). A distinctive feature of the Company’s remuneration system is that it incorporates both financial and non-financial indicators. .

Remuneration for outside directors and directors who are Audit & Supervisory Committee members consists solely of monthly fixed monetary payments to ensure their independence from management.

Remuneration System for Directors

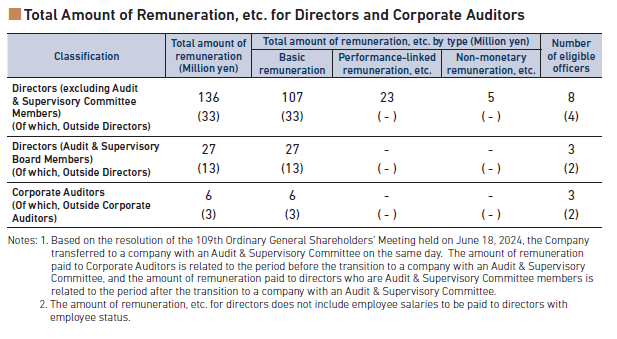

Total Amount of Remuneration, etc. for Directors and Corporate Auditors

Refund of compensation, etc. (Mars clause, clawback clause)

To ensure the soundness of the remuneration system, if certain events occur—such as serious violations of internal regulations or other unlawful acts, or material accounting errors that affect the indicators used for calculating remuneration—the Company may seek to forfeit unpaid remuneration (Malus Clause) or reclaim paid remuneration (Clawback Clause) based on the decision of the Board of Directors after deliberation by the Nomination & Remuneration Advisory Committee.