What is the company's growth strategy?

Mid-term management plan

With “Pioneering the Future through Agile Management” as our basic policy, we aim to enhance our organizational adaptability and competitiveness through agile management that responds quickly and flexibly to change.

We will accelerate business growth by focusing on four strategic pillars:

・Pursue greater profitability in core businesses

・Advance development for future commercialization

・Create new value through business synergy

・Further strengthen the business foundation

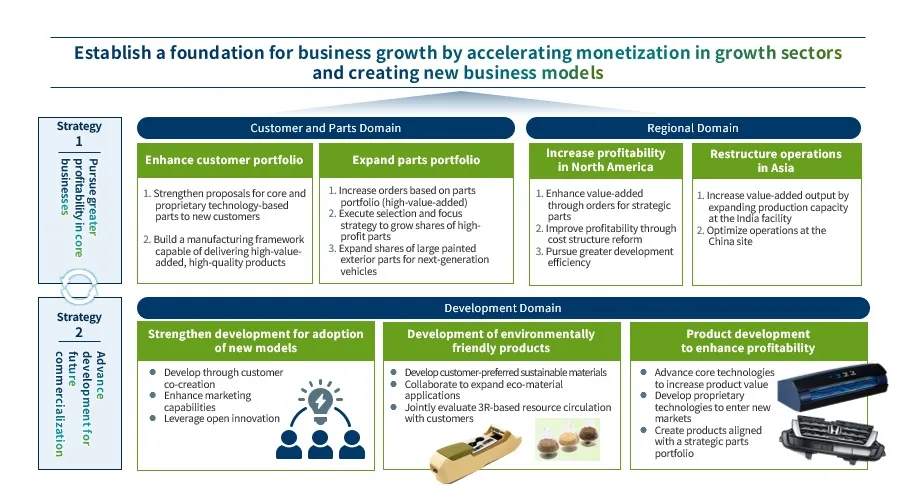

Resin-Treated Product Business Strategy

We will pursue further profit based on our customer and parts portfolios, increase profitability in North America, and restructure operations in Asia. In addition, we aim to expand our business over the long term by developing products that contribute to the adoption of new models, reduce environmental impact, and enhance profitability.

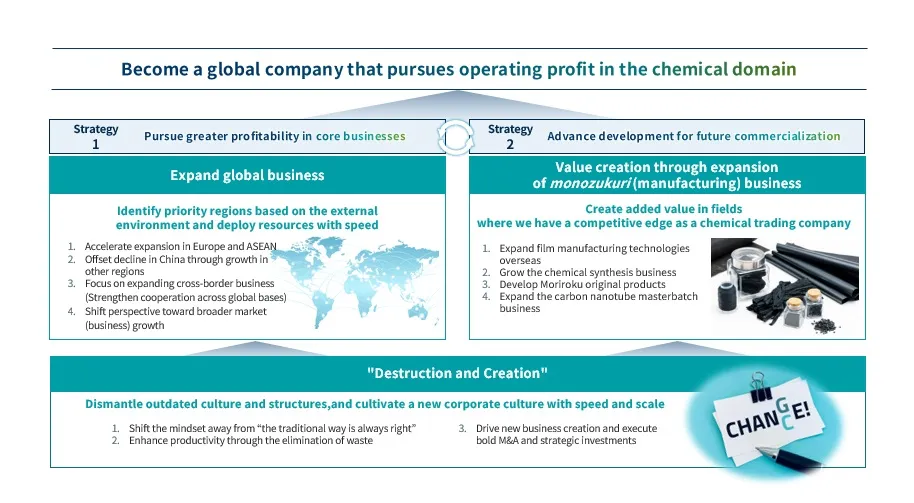

Chemicals Business Strategy

We will rapidly grow our global business while also expanding the monozukuri (manufacturing) business. At the same time, we will work to expand sales of products that leverage our unique technologies, increase the market share of competitively strong products, and further developing original materials.

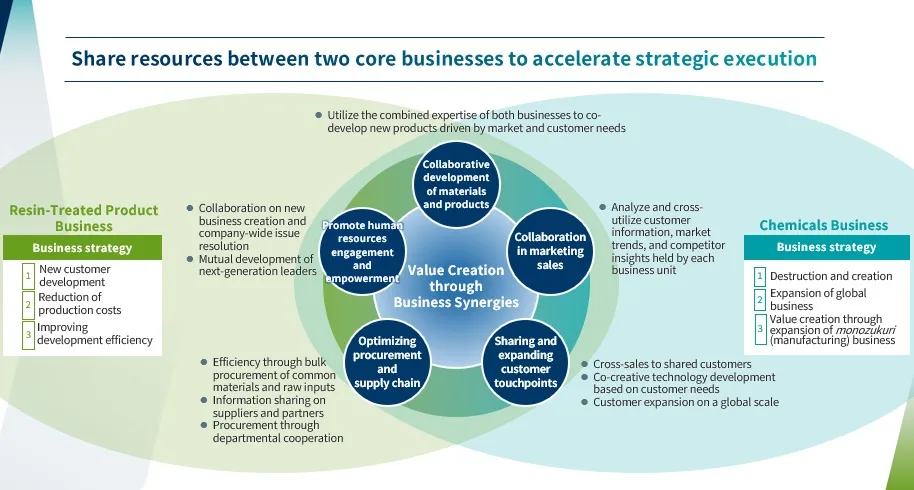

Creation of Business Synergies

We aim to create new value by combining the expertise and management resources of Resin-treated product business and Chemicals business.

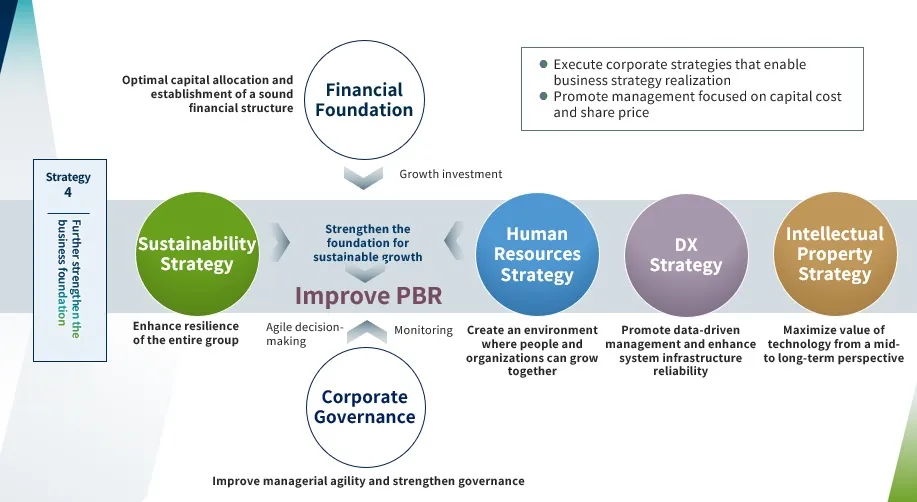

Further strengthen the business foundation

We aim to build a solid management foundation in a competitive global environment by integrating corporate and business strategies, and maximizing human resources through the recruitment and development of diverse talent.

Back to the index of "To all individual investors"