Stock-Related Information

- General Stock Information

- Status of shares

- Share indices

- Dividend payments

- Repurchase and cancellation of treasury stock

- Bonds and Ratings

General Stock Information

Financial year |

April 1 until March 31 of the following year |

|---|---|

Annual meeting of stockholders |

June |

Record dates |

Annual stockholders' meeting voting right : March 31 |

Inquiries / office procedures |

For inquiries about stocks or office procedures contact: Moriroku Company, Ltd. Administrative Division

Shin Aoyama Building East (18th floor), |

Manager of stockholders' list |

Mitsubishi UFJ Trust and Banking Corporation |

Handling places |

Mitsubishi UFJ Trust and Banking Corporation |

Number of stocks per unit |

100 |

Kind of stock certificates |

Not issued. |

Method of giving public notices |

The method of public notices of the company shall be by electronic notification (by giving them on its homepage); provided, however, that such notices shall be given by publication in the Nihon Keizai Shinbun in cases the method of electronic public notices is not available due to any troubles or unavoidable circumstances. |

Articles of Incorporation |

|

Status of shares

Total No. of shares authorized to be issued |

60,000,000 |

|---|---|

Total No. of outstanding shares |

14,410,000 |

Number of liquid stocks |

12,165,202 |

As of September 30, 2025

Movements in total number of outstanding shares, capital, etc.

|

Date

|

Difference in total number of outstanding shares

(shares)

|

Balance of total number of outstanding shares

(shares)

|

Difference in capital

(Million yen)

|

Balance of capital

(Million yen)

|

Difference in capital reserves

(Million yen)

|

Balance of capital reserves

(Million yen)

|

|---|---|---|---|---|---|---|

|

October 4,

2017*1 |

8,480,000

|

16,960,000

|

-

|

1,640

|

-

|

1,386

|

|

November 22,

2023*2 |

-1,500,000

|

15,460,000

|

-

|

1,640

|

-

|

1,386

|

|

August 27,

2024*2 |

-600,000

|

14,860,000

|

-

|

1,640

|

-

|

1,386

|

| June 30, 2025*2 |

-450,000 | 14,410,000 | - | 1,640 | - | 1,386 |

*1 Based on a shareholder split (1:2).

*2 Decrease due to cancellation of treasury stock.

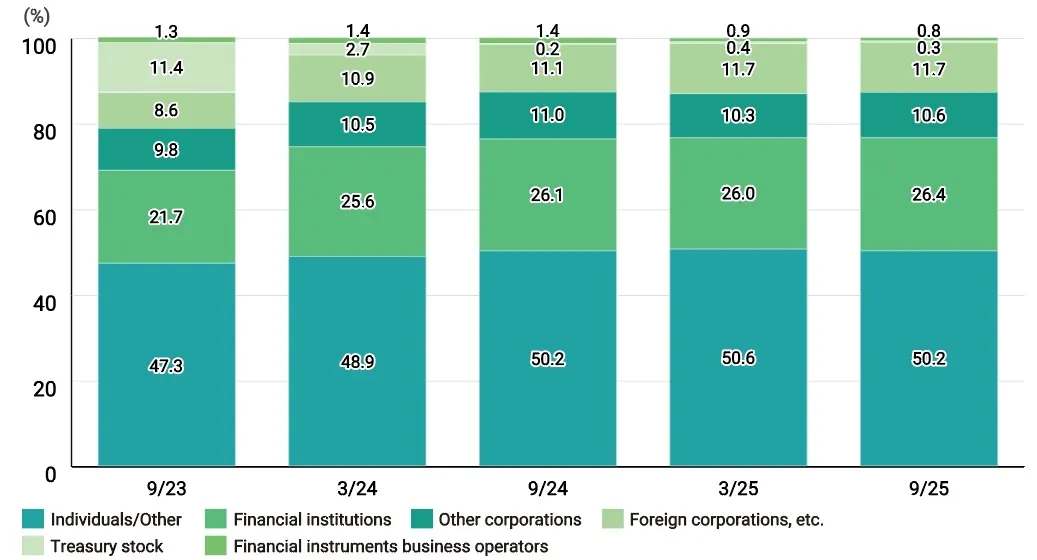

Movements in share status according to holder

Number of shares ratio (%)

|

|

September 2023 |

March 2024 |

September 2024 |

March 2025 |

September 2025 |

|---|---|---|---|---|---|

|

Individuals/Other

|

47.3

|

48.9

|

50.2

|

50.6

|

50.2

|

|

Financial

institutions

|

21.7

|

25.6

|

26.1

|

26.0

|

26.4

|

|

Other corporations

|

9.8

|

10.5

|

11.0

|

10.3

|

10.6

|

|

Foreign corporations, etc.

|

8.6

|

10.9

|

11.1

|

11.7

|

11.7

|

|

Treasury stock

|

11.4

|

2.7

|

0.2

|

0.4

|

0.3

|

|

Financial instruments

business operators

|

1.3

|

1.4

|

1.4

|

0.9

|

0.8

|

Largest shareholders

|

Name of Shareholder

|

No. of Shares Held

|

Shareholding Ratio (%) |

|---|---|---|

|

Custody Bank of Japan, Ltd. (Sumitomo Mitsui Trust Bank, Limited Re-trust Account, Mitsui Chemicals, Inc. Pension Trust Account) |

1,416,000

|

9.85

|

|

The Master Trust Bank of Japan, Ltd. (Trust Account)

|

1,363,500

|

9.49

|

|

Moriroku Employee Shareholding Plan

|

1,105,338

|

7.69

|

|

Shigeru Mori

|

966,560

|

6.73

|

|

Honda Motor Co., Ltd.

|

792,000

|

5.51

|

|

The Awa Bank, Limited.

|

526,000

|

3.66

|

|

CHARLES SCHWAB FBO CUSTOMER

|

461,100

|

3.21

|

|

Custody Bank of Japan, Ltd. (Trust Account)

|

300,600

|

2.09

|

|

ToShiko Isome

|

260,476

|

1.81

|

|

Toyoko Mori

|

257,823

|

1.79

|

As of September 30, 2025

-

*

Treasury stocks have been deducted in calculating shareholding ratios.

Share indices

The primary indices for Moriroku shares are as follows (As of June 2025. Limited to indices that the Company is aware of.)

-

Nomura RAFI

-

S&P/JPX Carbon Efficient

The Moriroku Group will endeavor to reduce carbon emissions per unit of net sales based on the incorporation of its shares in the “S&P/JPX Carbon Efficient” a global environment share index.

Dividend payments

We have positioned the return of profits to its shareholders as one of its priority management policies. Our basic policy in this regard is to continue distributing stable dividends while securing the internal reserves needed to accommodate our future business development and shifts in our operating environment.

With respect to dividends, we use the dividend on equity (DOE) as a key indicator and aim to raise it to a level of 3.0% by the fiscal year ended March 31, 2028.

The amounts are dividends per share

|

Fiscal year

ended March 31

|

Interim

dividend

|

Fiscal year-end

dividend

|

Annual

dividend

|

Dividend

on equity (DOE) |

|---|---|---|---|---|

|

2026

|

57.5 yen

|

(57.5 yen)

|

(115.0 yen)

|

(2.7%)

|

|

2025

|

52.5 yen

|

52.5 yen

|

105.0 yen

|

2.1%

|

|

2024

|

50.0 yen

|

50.0 yen

|

100.0 yen

|

2.2%

|

|

2023

|

47.0 yen

|

53.0 yen

|

100.0 yen

|

2.2%

|

|

2022

|

47.0 yen

|

47.0 yen

|

94.0 yen

|

2.2%

|

Repurchase and cancellation of treasury stock

Currently, we do not repurchase treasury stock.

Repurchase history

|

Repurchase Period

|

Number of Shares Repurchased(shares)

|

Amount of Shares Repurchased(yen)

|

|---|---|---|

|

March 18, 2025 – June 2, 2025

|

430,200

|

999,949,681

|

|

December 19, 2023 - July 31, 2024

|

369,500

|

999,788,246

|

|

November 17, 2022 -November 16, 2023

|

520,200

|

999,958,438

|

|

March 1, 2022 - October 26, 2022

|

560,400

|

999,852,728

|

|

December 3, 2021 - February 18, 2022

|

530,700

|

999,889,400

|

Cancellation history

|

Cancellation date

|

Number of shares cancelled(shares)

|

Total number of shares outstanding

after cancellation(shares)

|

|---|---|---|

|

June 30, 2025

|

450,000

|

14,410,000

|

|

August 27, 2024

|

600,000

|

14,860,000

|

|

November 22, 2023

|

1,500,000

|

15,460,000

|

Bonds and Ratings

Bonds

We haven't issued any bonds.

Rating

We haven't got ratings.