Basic approach to corporate governance

Our Management Philosophy is “Moriroku Group will create high value with its future-oriented creativity and advanced technologies, while contributing to the global society.” By practicing this, the Moriroku Group's basic approach to corporate governance is to ensure transparency, fairness, and timeliness in management decision-making. The aim is to continuously increase its corporate value over the medium and long term, as well as to fulfill the Group's social responsibilities by maintaining close relations with all types of stakeholders, including customers, business partners, employees, local communities, and shareholders, in order to earn their trust.

Compliance with the Corporate Governance Code

The status of the Company's compliance with the Corporate Governance Code is shown in the attachment.

Strategic Shareholding Policy

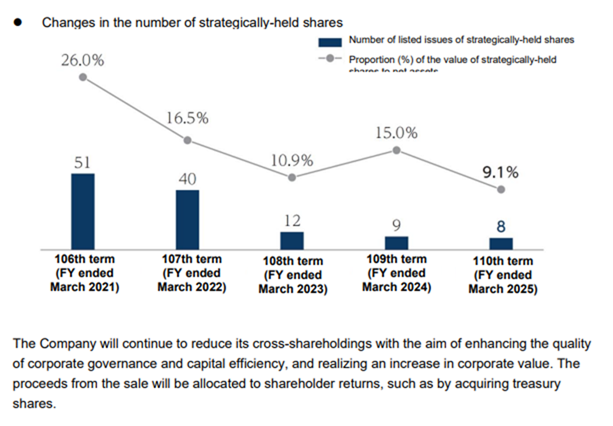

The Company examines whether shares for strategic purposes will be able to help maintain and reinforce business relationships and realize sustainable growth and a medium- to long-term increase in corporate value and whether the holdings may cause risks, etc. Only in the case that rationality can be recognized does the Company decides to acquire and hold such shares. Regarding shareholdings, the Board of Directors regularly verifies them based on quantitative evaluation such as transaction amounts and profit margin, and does a qualitative assessment on aspects such as future prospects, and then makes decisions on whether to continue holding. Based on the verification results, the Company sold 3 issues of listed shares in FY2023. In addition, the Company acquired 2 issues of unlisted shares for purposes of investing in venture companies that will lead to the creation of new businesses. We will continue to reduce shares held for strategic purposes in order to further improve asset efficiency and strengthen our financial position. Sales proceeds from the reduction of shares held for strategic purposes will be used for investments in new businesses and shareholder returns to enhance our corporate value.

The Company shall, when exercising voting rights for listed shares held, consider whether to approve or disapprove each proposal, while comprehensively taking into account the impact of the proposal on the medium- to long-term corporate value of the investee companies.