Message from the Vice President

- FYE March 2025 performance review

- Execute growth strategies to shift to an aggressive stance in the 14th Mid-Term Management Plan

- Balance business growth and capital efficiency toward realizing ROE exceeding the cost of capital

- Deepen dialogue with shareholders and investors to realize sustainable growth

FYE March 2025 performance review

In the fiscal year ended March 2025—the final year of the 13th Mid-Term Management Plan (FYE March 2023–FYE March 2025)— net sales rose slightly by 0.4% year on year to 146.1 billion yen, supported by increased production in the Resin-Treated Product Business in North America. However, substantial production reductions by Japanese automakers in China and other parts of Asia led to a 27.5% decline in operating profit to 4.1 billion yen. Additionally, we recorded a 6.6 billion yen loss in connection with the transfer of our Mexican subsidiary and recognized a 4.2 billion yen impairment loss in our Chinese subsidiary. As a result, the fiscal year ended with a net loss of 7.8 billion yen. Consequently, while we achieved the final-year target of 143 billion yen in net sales under the 13th Mid-Term Management Plan—partly due to the weaker yen—we did not meet our profit targets of 11 billion yen in operating profit and 9.1% in ROE. Although the fiscal year ended March 2025 presented a challenging business environment, we have nearly completed the disposal of unprofitable businesses and laid a solid foundation for future growth.

Execute growth strategies to shift to an aggressive stance in the 14th Mid-Term Management Plan

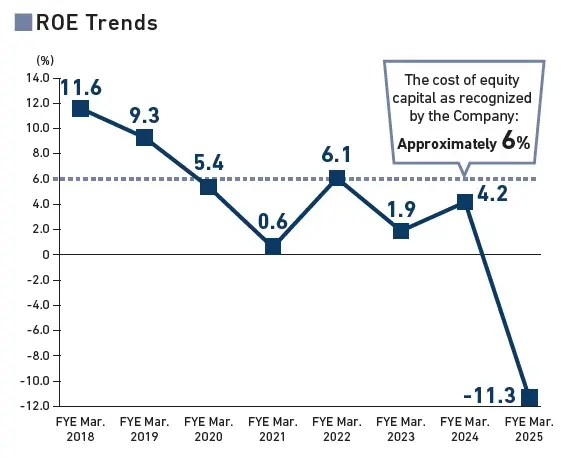

Under the 14th Mid-Term Management Plan (FYE March 2026–FYE March 2028), announced in May 2025, we aim to achieve an operating profit of 5.0 billion yen and an ROE of 5.0% or higher in FYE March 2026. From FYE March 2027 onward, we will set specific annual targets in response to changes in the business environment, seeking to achieve 110% operating profit growth (compared with FYE March 2026) and an ROE of at least 6.0% by FYE March 2028, the final year of the plan. While maintaining financial discipline, we will steadily execute measures to transition to an aggressive stance—an initiative left unfinished in the previous plan—and strive to enhance corporate value by raising profitability.

Specifically, in the Resin-Treated Product Business, we plan capital investments of approximately 29 billion yen to expand production facilities for new model launches and to upgrade molding equipment for automation. We will also continue to reinforce our competitiveness through research and development, while promoting technological innovation for future growth. In the Chemicals Business, we will expand our global footprint while advancing our monozukuri (manufacturing) initiatives, and aim to enhance profitability by increasing sales of high-value-added products developed using proprietary materials and technologies.

Balance business growth and capital efficiency toward realizing ROE exceeding the cost of capital

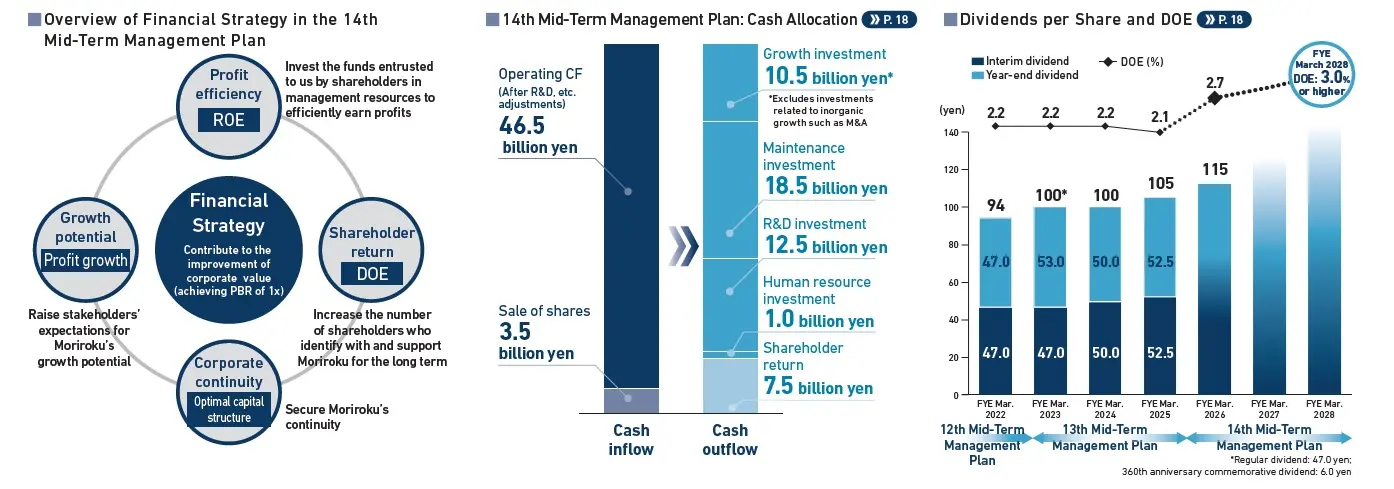

In November 2023, we announced a management policy targeting a price-to-book (P/B) ratio above 1x, while working to enhance ROE and reduce the cost of capital. In the 14th Mid-Term Management Plan, we will continue to pursue management focused on capital efficiency and share price improvement.

The Company’s cost of equity is estimated at around 6%. However, during the 13th Mid-Term Management Plan, ROE remained below this level due to a challenging business environment. Under the 14th Mid-Term Management Plan, we have formulated a cash allocation policy designed to financially support strategies that accelerate business profit growth—such as further pursuit of profitability in core businesses, promotion of development leading to commercialization, and creation of business synergies— with the aim of achieving ROE above our cost of capital. We estimate that operating cash flow generated over the three-year period will total approximately 46.5 billion yen. We will allocate funds efficiently across key areas—including capital investment, R&D, and human resources—while maintaining a sound financial base and ensuring both growth and capital efficiency. In addition, we will consider strategic investments in inorganic growth opportunities such as M&A and business alliances, expanding fundraising limits as necessary to strengthen our balance sheet and ensure both financial safety and efficiency.

Furthermore, we are promoting the reduction of cross-shareholdings as a measure to improve capital efficiency. We have been working to reduce this ratio of cross-shareholdings to net assets to 10% or less, and we reached 9.1% by the end of the fiscal year ended March 2025, achieving the level we aimed at. Proceeds from the sale of these shares will be used for growth investments and the enhancement of shareholder returns including the acquisition of treasury shares.

Deepen dialogue with shareholders and investors to realize sustainable growth

In November 2023, we revised our shareholder return policy and introduced the Dividend on Equity (DOE) ratio that focuses on stable dividends over the medium to long term. In the fiscal year ended March 2025, following the disposal of unprofitable divisions, the final profit and loss marked a large deficit. We maintained our policy of stable annual dividends, raising the annual dividend to 105 yen, up 5 yen year on year (DOE: 2.1%). In the 14th Mid-Term Management Plan, we have set a target of achieving a DOE of 3.0% or higher in the final year. In order to achieve an appropriate capital structure, we will implement measures such as share buybacks as necessary, and will continue to work to increase shareholder value, with a view to increasing dividends in line with business growth.

At the same time, we recognize the importance of clearly communicating our growth story to stakeholders and taking initiatives to reduce the cost of capital. We will continue to expand dialogue with both institutional and individual investors and enhance information disclosure through our website. In particular, we will proactively disclose non-financial information to deepen understanding of the Group’s sustainability initiatives, thereby advancing sustainability management and strengthening investor relations activities.