Risk Management

Basic Concept

Moriroku Group defines "risk" as any event or action that may impede the achievement of business objectives or have undesirable effects. To ensure business continuity and stable growth, we have established a management system to accurately identify, evaluate, and respond to various risks associated with our business.

For details on business and other risks, please refer to the Annual Securities Report.

Basic Policy for Risk Management

The Moriroku Group performs risk management in accordance with the policy below. The purpose is to ensure the continuity and stable growth of the businesses of the Group by taking actions, including accurately identifying, evaluating, and addressing various risks surrounding the businesses of the Group.

-

Promote risk management by establishing a group-wide and comprehensive risk management system.

-

Bring risks to light, evaluate them and develop and carry out countermeasures against them as well as monitor, rectify and improve the situation in a repeated and systematic manner, thereby aiming to sustainably enhance the capability to respond to risks.

-

In the case of the occurrence of a risk, respond swiftly and accurately to minimize the damage, and simultaneously, make efforts for prompt restoration and prevention of recurrence to retain trust from society.

-

In the event of the occurrence of an accident or disaster risk, give top priority to human lives to ensure the safety of officers and employees, and on top of that, aim for the continuity of business to the extent possible.

-

Heighten consciousness of risks through awareness-raising activities for officers and employees and the sharing of risk information with them, and make constant efforts to reduce the possibility of a risk, prevent the occurrence of loss and mitigate loss in normal times.

-

Review the risk management system, including this basic policy, periodically and make continuous improvements to ensure that risk management functions effectively at all times.

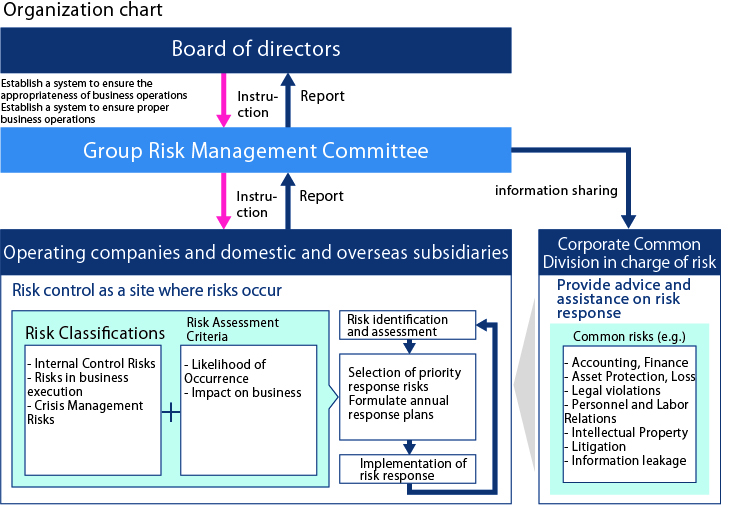

Risk Management System and Initiatives

The Moriroku Group has established the "Basic Risk Management Policy" and the "Basic Risk Management Policy" as its risk management system.

The "Regulations" have been established. Global foresight of potential risks in operating companies and overseas subsidiaries,

We aim to minimize risk by responding in advance.

Once a year, operating companies and domestic and overseas subsidiaries are required to submit a report on risk items common to the Group, evaluation criteria (impact on business, etc.), and the impact of the risk on the Group's business.

(likelihood of occurrence) to assess, identify, and prioritize risks. Based on the results, the annual

Response plans are developed and implemented.

The department responsible for handling common corporate risks is responsible for providing risk management services to the operating companies and domestic and overseas subsidiaries.

Responsible for advice and support.

In the event that a risk materializes and a crisis occurs, the Company shall promptly notify the management and the Board of Directors in accordance with the "Basic Rules for Risk Management".

A system has been established whereby the relevant departments are informed and prompt action is taken.

The Board of Directors shall meet once a year to discuss the Group's risk management system and the status of its initiatives.

The results will be discussed and reflected in the next year's response plan.

Through these activities, we will establish risk management activities at operating companies and overseas subsidiaries,

We aim to reduce risk throughout the Group and to raise the risk awareness of each and every employee.

Risk Information

Key Risks

Among matters related to the status of the businesses, accounting and others of the Group, the major risks that the Group recognizes as having the potential to have a material impact on its financial standing, operational results and the status of cash flows are as follows. The following items, however, describe only major risks of the Group, and do not cover the risks of the Group comprehensively. Accordingly, the Group considers that it is possible that there are unpredictable risks in addition to the above risks.

Forward-looking matters in the descriptions are ones that the Group decided to list as of the end of the consolidated fiscal year under review.

Changes in the market

- Risk description

-

The Group develops business in countries across the world, including Japan, North America, Europe and Asia. It is possible that an economic downturn, social and economic disruptions caused by an epidemic, and the resulting decline in demand in these markets could affect the Group’s operating results, financial standing and other matters.

- Countermeasures against risks

-

The Group constantly monitors changes in the economic conditions of countries in the world, and the head office and overseas sites unite in taking measures that suit the situation.

Overseas Activities

- Risk description

-

The Group has been active in expanding into overseas markets. Overseas, it is possible that unexpected changes to legal regulations, the occurrence of unpredictable events mainly caused by local customs, and others could affect the Group’s operating results, financial standing and other matters.

- Countermeasures against risks

-

The Group proactively gathers local information and shares it internally in order to respond appropriately to local issues such as legal regulations and customs. In this regard, internal seminars and others will be held to improve education for employees.

Dependence on specific clients

- Risk description

-

The Group’s main customers are Honda Motor Co., Ltd., and its group companies (hereinafter referred to as "Honda Motor"), and they account for more than 90% of net sales in the Resin processed product business.

It is possible that fluctuations in the number of vehicles produced and sales trends of Honda Motor could affect the Group’s operating results, financial standing and others. - Countermeasures against risks

-

The Group is carrying out new technological innovations by combining its unique resin processing technology and chemical materials technology, thereby winning new customers in the mobility field.

In addition, the Group has pushed forward with optimally allocating resources and business portfolios and aims to expand into other business fields.

Dependence on certain suppliers for raw materials, parts and commodities

- Risk description

-

The Group purchases raw materials, merchandise, and parts (hereinafter referred to as “purchased items”) from a great number of external suppliers. However, the Group depends on a limited number of suppliers for several purchased items that are used for production and sale of products. Therefore, in the event that the Group cannot receive stable supplies of these purchased items from major suppliers for any reason, it is possible that the Group’s production and sales activities could be impacted, ending up affecting its operating results, financial standing and other matters.

- Countermeasures against risks

-

To safeguard the stable procurement of purchased items, the Group is working to diversify its supply chains so as to get hold of multiple suppliers while confirming new moves with customers.

-

Procure goods from multiple business sites in and outside Japan.

-

Secure suppliers in regions in which the Group has a business site.

-

Get hold of multiple suppliers who can supply purchased items that have the same quality.

-

Product Quality

- Risk description

-

The Group manufactures products in accordance with internationally recognized quality control standards. In the event that a serious quality defect occurs with a manufactured product, it is possible that such a defect could cause huge amounts of costs or influence the Group’s evaluation by others, ending up affecting the Group’s operating results, financial standing and other matters.

- Countermeasures against risks

-

Having been certified with ISO 9001 for its quality management system and ISO/TS 16949 for its automotive industry quality management system, the Group produces various products and performs quality management in accordance with the above standards and endeavors to maintain and improve quality.

Should a problem occur, the Group has a system in place to enable response to the market quickly and without fail.

Creditworthiness of business partners

- Risk description

-

The Group engages in diverse business transactions and sells products on credit to buyers in and outside Japan, and this exposes the Group to credit risk. Although the Group makes efforts to procure merchandise and products in a stable and continuous manner, it may become difficult to do so due to a deterioration in the financial standing or bankruptcy of suppliers and others. It is possible that the manifestation of such risks could affect the Group’s operating results, financial standing and others matters.

- Countermeasures against risks

-

The Group collects information on the creditworthiness of business partners constantly to share the information internally. Based on this information, the Group revises trading terms and conditions and places a cap on monetary amounts of transactions depending on business trends and financial conditions, thereby managing credit limits and suppliers to mitigate credit risk.

Research and Development Activities

- Risk description

-

The Group advances the development of new products to satisfy customers. It is possible that the failure of new products or technologies that the Group developed gaining support from customers and markets could lower future growth and profitability, ending up affecting the Group’s operating results, financial standing and other matters.

- Countermeasures against risks

-

The Group expands development of innovative new products and technologies. The Group carries out R&D activities while grasping market needs through exchanging opinions with people in the industry on occasions such as technological presentations made to customers and when displaying newly developed products in domestic and overseas exhibitions.

Changes in raw material prices

- Risk description

-

The Group handles petrochemical products made from naphtha in a broad range of fields, including resins, industrial chemicals, organic chemicals, paints, oil and fat processing, electronic materials, and automobiles. Since petrochemical products form unique market conditions for each product, depending on the factors of the raw material market conditions and the supply-demand balance, it is possible that these fluctuations could affect the Group’s operating results, financial standing and other matters.

- Countermeasures against risks

-

The Group has taken measures to lower the risk of fluctuations in the market conditions, such as concluding transaction contracts based on a system that links the pricing of petrochemical products with naphtha prices.

As for in-stock merchandise, the Company proceeds with concluding transaction terms and conditions that are not influenced by market conditions through actions such as entering into contracts that fix volumes and prices of the lot with business partners.

Fluctuations in exchange rates

- Risk description

-

The Group conducts transactions denominated in foreign currencies. It is possible that yen-translated prices in transactions denominated in foreign currencies, resulting from fluctuations of exchange rates, could affect the Group’s operating results, financial standing and other matters. The Group has subsidiaries overseas and prepares financial statements denominated in foreign currencies. The preparation of consolidated financial statements is subject to currency translation risks arising from conversion from foreign currencies to the yen.

- Countermeasures against risks

-

The Group hedges its foreign currency transactions with forward foreign exchange contracts to minimize the risk of foreign currency fluctuations.

Changes in interest rates

- Risk description

-

The Group procures funds for its operating and investment activities by borrowing funds from financial institutions, etc. However, some interest-bearing liabilities are subject to the condition that interest rates vary. Therefore, it is possible that interest rate trends in the future could affect the Group’s operating results, financial standing and other matters.

- Countermeasures against risks

-

The Group, in preparation for a rise in interest rates in the future, takes measures to mitigate risks accompanying interest rate trends, such as choosing fixed rates for long-term funds.

Stock Price Fluctuation

- Risk description

-

The Group has marketable stocks. Therefore, it is possible that a fluctuation in these stocks could affect the Group’s operating results, financial standing and other matters.

- Countermeasures against risks

-

The Group has taken measures to mitigate risks, such as continuously reviewing and reducing its shareholdings.

Intellectual Property Rights

- Risk description

-

The Group endeavors to accumulate unique technologies and know-how and acquire intellectual property rights. It is possible that an infringement of intellectual property rights by a third party could affect the Group’s business activities. In addition, the Group develops products and technologies while taking into consideration the intellectual property rights of third parties. However, in the case that the Group is judged to be infringing on the intellectual property rights of third parties and is sued for damages, etc., it is possible that such an event could affect the Group’s operating results, financial standing and other matters.

- Countermeasures against risks

-

The Group protects its technologies and others through owning or acquiring patents and trademarks for the products that it manufactures. Moreover, the Group strives to perform risk management so as to avoid infringements of intellectual property rights of other companies.

Natural Disasters

- Risk description

-

The group's major facilities in Japan are concentrated near the expected epicenters of the Tokyo Inland Earthquake and the Nankai Trough Mega Earthquake. Consequently, in the event of a major earthquake, our group's key facilities could directly suffer damage, leading to operational delays or interruptions. This situation has the potential to impact our group's financial performance and financial status.

- Countermeasures against risks

-

Our group has formulated a basic policy for BCP (Business Continuity Planning), prioritizing employee safety. The Group maintains and strengthen disaster prevention measures during peacetime, prepare emergency supplies, and conduct evacuation and disaster drills for all staff. Additionally, we have developed a BCP (Business Continuity Planning) aimed at enabling swift recovery post-disaster. This plan undergoes annual reviews to ensure its effectiveness and prevent it from becoming obsolete.

War, terrorism, infectious diseases, riots, strikes, and other man-made disasters

- Risk description

-

The group operates businesses worldwide, and in regions affected by war, terrorism, infectious diseases, riots, strikes, etc., there is a possibility of delays, disruptions, and halts in purchasing raw materials, components, production, sales of products, and logistics services. If these conditions persist, there is a potential impact on our group's financial performance and financial status.

- Countermeasures against risks

-

The group prioritizes the health and safety of employees above all else. Depending on the nature of the incident, the group follows our crisis management policies and guidelines to implement necessary measures. In cases of significant impact, we establish a response headquarters led by the President to coordinate comprehensive group-wide responses.

Legal restrictions

- Risk description

-

The Group is subject to diverse legal regulations, such as on sales of merchandise, safety standards, hazardous substances and levels of contaminated substances discharged from production plants, in countries in which the Group operates. Accordingly, the Group conducts business activities in compliance with such related laws and regulations.

However, in the case that these legal regulations are tightened or new ones are enacted in the future, the Group’s business activities can be restricted or costs for complying with these regulations can inevitably rise. It is possible that such events could affect the Group’s operating results, financial standing and other matters. - Countermeasures against risks

-

The Group is active in gathering information and sharing it internally in order to respond appropriately to changes to legal regulations and others.

Should the Group violate legal regulations, the Group has a system in place for responding to the market swiftly and without fail.

Information Security

- Risk description

-

The Group possesses confidential and personal information necessary for its business. It is possible that cases of any leakage or loss of confidential information resulting from external cyber terrorism and computer virus infection, or infrastructure failure caused by natural disasters could affect the Group’s operating results, financial standing and other matters.

- Countermeasures against risks

-

The Group has formulated information system security regulations that clarify appropriate handling methods for information system resources, and has implemented safety measures to protect information assets such as hardware, software, and data. Additionally, the Group provides information security education to its employees, thereby making their knowledge and mindset regarding information security take root.

Impairment loss on fixed assets

- Risk description

-

The Group owns non-current assets such as property, plant and equipment. Therefore, in the case that the need for reporting an impairment loss of non-current assets arises in the wake of a drastic change to the management environment of businesses to which the assets or the asset groups belong, or aggravation in the revenue state, it is possible that such a case could affect the Group’s operating results, financial standing and other matters.

- Countermeasures against risks

-

The Group judges whether or not there are signs of an impairment loss of non-current assets. In the case that the Group detects an asset or an asset group that has signs of impairment loss and the total of undiscounted future cash flows to be gained from the asset or the asset group is below its book value, the Group makes it a rule to decrease the book value to the recoverable amount and record an impairment loss appropriately.